Before you file your 2011 federal income tax return in 2012, you should be aware of a few important tax changes that took effect in 2011. Check http://www.irs.gov/ before you file for updates on any new legislation that may affect your tax return.

Before you file your 2011 federal income tax return in 2012, you should be aware of a few important tax changes that took effect in 2011. Check http://www.irs.gov/ before you file for updates on any new legislation that may affect your tax return.

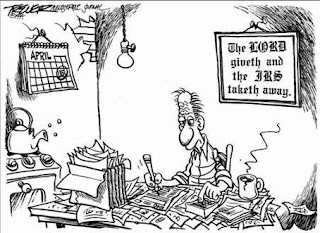

Due date of return. File your federal tax return by April 17, 2012. The due date is April 17, instead of April 15, because April 15 is a Sunday and April 16 is the Emancipation Day holiday in the District of Columbia.

New forms. In most cases, you must report your capital gains and losses on the new Form 8949, Sales and Other Dispositions of Capital Assets. Then, you report certain totals from that form on Schedule D (Form 1040). If you had foreign financial assets in 2011, you may have to file the new Form 8938, Statement of Foreign Financial Assets, with your return.

Standard mileage rates. The 2011 rates for mileage are different for January 1 through June 30 than for July 1 through December 31. For business use of your car, you can deduct 51 cents a mile for miles driven the first half of the year and 55 ½ cents for the second half. Medical and moving mileage are both 19 cents per mile for the early half of the year and 23 ½ cents in the latter half.

Standard deduction and exemptions increased.

The standard deduction increased for some taxpayers who do not itemize deductions on IRS Schedule A (Form 1040). The amount depends on your filing status.

The amount you can deduct for each exemption has increased $50 to $3,700 for 2011.

Self-employed health insurance deduction. This deduction is no longer allowed on Schedule SE (Form 1040), but you can still take it on Form 1040, line 29.

Alternative minimum tax (AMT) exemption amount increased. The AMT exemption amount has increased to $48,450 ($74,450 if married filing jointly or a qualifying widow(er); $37,225 if married filing separately).

Health savings accounts (HSAs) and Archer MSAs. The additional tax on distributions from HSAs and Archer MSAs not used for qualified medical expenses increased to 20 percent. Beginning in 2011, only prescribed drugs or insulin are qualified medical expenses.

Roth IRAs. If you converted or rolled over an amount from a traditional IRA to a Roth IRA or designated Roth in 2010 and did not elect to report the taxable amount on your 2010 return, you generally must report half of it on your 2011 return and the rest on your 2012 return.

Alternative motor vehicle credit. You can claim the alternative motor vehicle credit for a 2011 purchase only if the vehicle is a new fuel cell motor vehicle.

First-time homebuyer credit. The credit expired for most taxpayers for 2011. Some military personnel and members of the intelligence community can still claim the credit in 2011 for qualified purchases.

Health coverage tax credit. Recent legislation changed the amount of this credit, which pays qualified health insurance premiums for eligible individuals and their families. Participants who received the 65 percent tax credit in any month from March to December 2011 may claim an additional 7.5 percent retroactive credit when they file their 2011 tax return.

Mailing a return. The IRS changed the filing location for several areas. If you're mailing a paper return, see the Form 1040 instructions for the correct address.

Detailed information on these changes can be found on the IRS website – http://www.irs.gov/.

Links:

Form 1040 instructions (PDF 941K)

Form 8949, Sales and Other Dispositions of Capital Assets